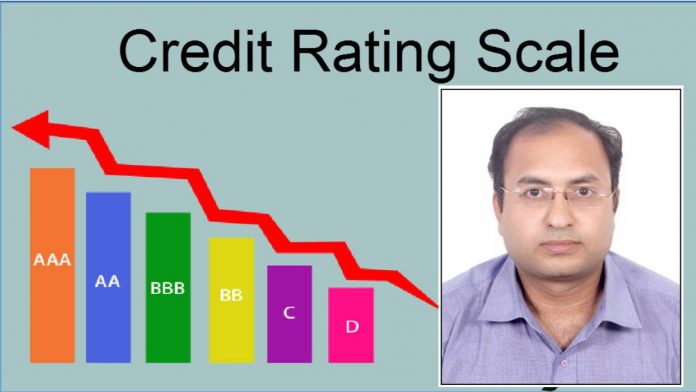

Credit ratings, whether internal or external, has been an important tool in assessing the risk profile and lending suitability of a borrower. As an integral component in credit decision making, banks and financial institutions have historically relied on the rating category of the client. An external credit rating is done by a domestic/ International credit rating agency. In our country, at present there are seven domestic credit rating agencies accredited by the RBI. These are CARE, CRISIL, India Ratings and Research Private Limited (India Ratings), ICRA, Brickwork, SMERA and INFOMERICS. Some of the International Credit Rating AgenciesareMoody’s, Standard & Poor and FITCH. A high credit rating indicates higher financial soundness of the company.

advisory serviceover the tenure of their association. This certainly will be considered progressive and a step up in the conventional lending relationship. Incremental advantage will be greater client integration and stickiness.

Article By : Mr. Shailesh Kumar Jha

Chief Manager and Faculty,

State Bank Institute of Learning and Development, Ajmer.