India’s central bank is a full service organisation and, in addition to most of the functions of a typical central bank, performs certain other unique functions.

The RBI has been constituted under the RBI Act, 1934. The legal backing for the functions of the RBI are not only confined to the provisions of the RBI Act, but also spread over a number of statutes, such as the Banking Regulation Act, 1949, Foreign Exchange Management Act, 1999, Government Securities Act, 2006, Payment and Settlement Systems Act, 2007, etc.

Functions:

-

Monetary Policy:

Over time, the role of Monetary Policy in India evolved to maintain a judicious balance between price stability, economic growth and financial stability. However, pursuant to the amendment to RBI Act, 1934, in May 2016, the primary objective of monetary policy is to maintaining price stability while keeping in mind the objective of growth. The amended RBI Act, 1934, also provides for an empowered six-member Monetary Policy Committee (MPC) to be constituted by the Central Government to determine the policy interest rate required to achieve the inflation target.

2. Market Operations:

The Reserve Bank of India conducts market operations in the money, government securities and foreign exchange markets. These operations are primarily motivated by the twin objectives of monetary policy implementation and financial stability. RBI also intervenes in the foreign exchange market to curb excessive volatility and preserve orderly conditions

3.Financial Stability:

Financial stability is one of the main mandates of a central bank as a stable financial system promotes economic development. An unstable financial system adversely affects the intermediation process and retards economic growth. The financial crisis has reinforced the importance of financial stability. The Board for Financial Supervision and the Board for Payment and Settlement Systems, both committees of the Central Board of Directors, were constituted to aggregate information pertaining to the financial system as a whole and take informed decisions to deal with any signs of instability, both at the individual institution level and at the system level. The lender of last resort facility as well as central bank experience in ensuring price and exchange rate stability makes the central banks’ role in maintaining financial stability even more significant

4. Regulation and Supervision of financial system:

The regulation and supervision of the financial system in India is carried out by different regulatory authorities. The Reserve Bank regulates and supervises the major part of the financial system. The supervisory role of the Reserve Bank covers commercial banks, Urban Co-operative Banks (UCBs), certain Financial Institutions (FIs) and Non-Banking Financial Companies (NBFCs). Supervision, in simple terms, is the enforcement of rules and regulations that are formulated by the regulator to govern the behaviour of regulated institutions. The Department of Banking Supervision (DBS) is responsible for supervision of scheduled commercial banks, including small finance banks and payments banks.

Examples of regulation function: bank licensing, branch expansion, maintenance of statutory reserves etc, Examples of supervision function- PCA, off site monitoring etc. Regulation and supervision of NBFCs: The RBI regulates only those NBFCs that are engaged in bank like activities performing credit intermediation and satisfying a ‘principle business criteria’. The RBI has put in place a four pronged supervisory framework based on:

- On-site inspection;

- Off-site monitoring supported by state-of-the art technology;

- Market intelligence; and

- Exception reports of statutory auditors of NBFCs

5. Development and regulation of financial markets:

Some of the examples of the developmental roles for financial markets are- increasing participation, increasing market liquidity, risk management etc.

6. Regulation of Financial market infrastructure:

Payment and settlement systems provide the critical network connecting all the financial institutions. Central banks monitor and oversee payment systems by setting the rules. Central banks have traditionally been facilitating the payment systems as a matter of public policy.

As the banker to the banks and to the Government, the central banks also operate also as a participant of the payment and settlement systems. Some FMIs regulated by the RBI are- RTGS etc.

7. Currency management:

Along with the Government of India (GoI), the RBI is responsible for the design, production, distribution and overall management of the country’s currency, with the goal of ensuring an adequate supply of clean and genuine notes. The main function includes supply and distribution of adequate quantity of currency and ensuring of the quality of banknotes in circulation by continuous supply of clean notes and timely withdrawal of soiled notes. The RBI also endeavours towards maintaining public confidence in the currency by constantly enhancing the integrity of banknotes through new design and security features.

8. Banker to banks and banker to government:

For the proper functioning of the financial System, banks need an efficient mechanism to transfer funds and settle inter-bank transactions and customer transactions. As the banker to banks, the Reserve Bank fulfils this role. The RBI also extends credit facility in time of need to protect the interest of the bank depositors and to prevent possible failure of the bank (lender of last resort). As banker to the government, the RBI is responsible for the maintaining accounts of the Governments by handling their day-to-day banking transactions, issue and management of government borrowing and provision of ways and means advances.

Legal Provisions

- Sec.17 of RBI Act, 1934 – Business which the bank can transact including

- transactions with banks

- Sec.42 of RBI Act, 1934 – Maintenance of Cash Reserves by banks with RBI

- Under Sections 20 and 21 of the RBI Act, the RBI shall have an obligation and right respectively to accept monies for account of the Central Government and to make payments up to the amount standing to the credit of its account, and to carry out its exchange, remittance and other banking operations, including the management of the public debt of the Union.

9. Public Debt management:

Reserve Bank of India is the debt manager to Central Government and all State

Governments in India, and thus plays a vital role in the Economy. The ‘public debt’ is defined as how much the Government of a country owes to lenders outside of itself. Currently, the main objectives of public debt management in India are:

i) Meeting the Central Government’s financing needs at the lowest possible long term borrowing costs;

ii) Keeping the total debt within sustainable levels

iii) Placing the reliance on domestic borrowing over external debt and

iv) Developing deep and wide market for Government securities

10. Foreign exchange reserve management:

The Reserve Bank of India Act 1934 contains the enabling provisions for the RBI to act as the custodian of foreign exchange reserves and manage reserves with defined objectives.

11. Consumer education and protection:

Consumer protection has been an ongoing effort of Reserve Bank of India. The RBI had set up the Banking Ombudsman Scheme to act as a visible and credible alternative dispute resolution agency for common persons utilizing banking services and to ensure redress of grievances of users of banking services in an inexpensive, expeditious and fair manner that provides impetus to improve customer services in the banking sector on a continuous basis. It has also launched Ombudsman scheme for NBFCs.

12. Financial inclusion and development:

The Reserve Bank of India has assumed, as its core purpose, the development of an efficient and inclusive financial system. The efforts towards ensuring financial inclusion has been through mandates which include priority sector targets and targets under financial inclusion plans, encouraging the use of multiple methods of increasing access by creating differentiated banking outlets and increasing awareness though financial literacy. E.g. Business correspondents, PSL, Financial Literacy by Financial Literacy Centres and Rural Branches of Banks , Observation of Financial Literacy Week, Lead Bank Scheme (LBS) etc.

13. Development of Institutions:

A developing economy requires a wide range of institutions ranging from developmental finance institutions, market institutions, institutions for higher learning and specialized training and unique institutions like those for currency printing. The Reserve Bank has played an active part in setting up and nurturing these institutions. The institutions that RBI has enabled to set up include:

- Institutions for deposit insurance and credit guarantee

- Development of Financial Institutions

- Institutions for Research and Learning

- Market Institutions

- Reserve Bank Information Technology Pvt. Ltd (ReBIT)

- haratiya Reserve Bank Note Mudran Private Limited (BRBNMPL)

- Institutions for deposit insurance and credit guarantee

- Development of Financial Institutions

- Institutions for Research and Learning

- Market Institutions

- Reserve Bank Information Technology Pvt. Ltd (ReBIT)

- Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL)

14. RBI also performs researches, conducts surveys and data dissemination:

Besides publishing two statutory publications, namely ‘Annual Report’ and ‘Report on Trend and Progress of Banking in India’, Reserve Bank disseminates its research analysis done by its own employees, through its Bulletin, Occasional Papers and Working Paper Series. Concise analytical reports on contemporary issues are published in the RBI website (Mint Street Memos).

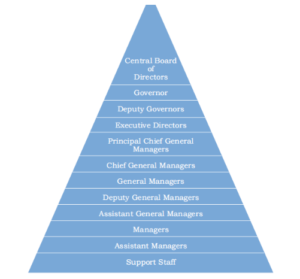

Organisational Structure:

The organizational structure of the Reserve Bank of India is as under:

The Central Board of Directors

The Central Board of Directors is the apex body in the governance structure of the Reserve Bank. There are also four Local Boards for the Northern, Southern, Eastern and Western areas of the country which take care of local interests. The central government appoints/nominates directors to the Central Board and members to the Local Boards in accordance with the Reserve Bank of India (RBI) Act. The composition of the Central Board is enshrined under Section 8(1) of the RBI Act, 1934. The Central Board consists of :

- The Governor, who is the Chair

- Four Deputy Governors of the Reserve Bank

- Four Directors nominated by the central government, one from each of the four

- Local Boards as constituted under Section 9 of the Act

- Ten Directors nominated by the central government and two government officials

- nominated by the central government.

The Central Board is assisted by three committees: the Committee of the Central Board (CCB), the Board for Financial Supervision (BFS) and the Board for Regulation and Supervision of Payment and Settlement Systems (BPSS). These committees are chaired by the Governor. In addition, the Central Board has four subcommittees, viz., the Audit and Risk Management Sub-Committee (ARMS); the Human Resource Management Sub-Committee (HRM-SC); the Building Sub- Committee (BSC) and the Information Technology Sub-Committee (IT-SC). These sub-committees are headed by an external director.

Offices and Branches

The units operating in the four metros — Mumbai, Kolkata, Delhi and Chennai — are known as offices, while the units located at other cities and towns are called branches. Currently, the Reserve Bank has its offices, including branches, at 31 locations in India

Subsidiaries of the RBI

The Reserve Bank has the following fully owned subsidiaries:

-

- Deposit Insurance and Credit Guarantee Corporation (DICGC)

- Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL)

- Reserve Bank Information Technology Pvt. Ltd.